Dear Reader,

This will be a four part series of fundamental analysis and valuation of the housing market.

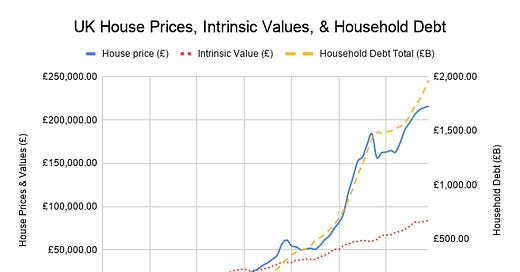

Part 1: I will explore whether or not a housing bubble exists by estimating the intrinsic value of real estate and comparing it to the price.

Part 2: I will look at how large the bubble is, pontificate on how the bubble formed, and attempt to explain …